ohio hotel tax calculator

Coupled with the state tax thats 1750 percent. The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Ohio residents only.

148 average effective rate.

. The main purpose of this department is to collect the 65 County bed tax which will then be disbursed to Medical Mart Municipalities and. Hotel Vendors License No. Usually the vendor collects the sales tax from the consumer as the consumer makes a purchase.

It is not a substitute for the advice of an accountant or other tax professional. The Ohio OH state sales tax rate is currently 575. 2 e and Tax Regulations of the Franklin County Convention.

Effective January 1 1969 the City of Columbus implemented a 3 tax on the room rental income of hotelsmotels located in Columbus Ohio. Collected from the entire web and summarized to include only the most important parts of it. You are able to use our Ohio State Tax Calculator to calculate your total tax costs in the tax year 202122.

The tax rate was increased to 4 effective September 1 1980 and to 6 effective September 1 1985. The Ohio State Tax Tables for 2018 displayed on this page are provided in support of the 2018 US Tax Calculator and the dedicated 2018 Ohio State Tax CalculatorWe also provide State Tax Tables for each US State with supporting tax calculators and finance calculators tailored for each state. A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

Please see Information Release IT 2018-01 entitled Residency Guidelines - Tax Imposed on Resident and Nonresident Individuals for Taxable Years 2018 And Forward as well as the General Information for the Ohio IT 1040 section of the individual income tax instructions. Other local-level tax rates in the state of Ohio are quite complex compared against local-level tax rates in other states. Ohio Sales Tax Calculator.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. For the 2020 tax. The Lodging Occupancy Tax Office is located on the third floor of the Cuyahoga County Fiscal Office.

Tax of up to 5 percent of gross rental receipts in addition to the states effective hotel occupancy tax rate of 564 percent. Our Ohio Property Tax Calculator can estimate your property taxes based on similar properties and show you how your property tax burden compares to the average property tax on similar properties in Ohio and across the entire United States. This division is responsible for the administration of the county lodging excise tax.

Our calculator has recently been updated to include both the latest Federal Tax Rates along with the latest State Tax Rates. Ohio has a 575 statewide sales tax rate but also has 556 local tax. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any time.

The Ohio Department of Revenue is responsible for publishing the latest Ohio State Tax. You can use our Ohio Sales Tax Calculator to look up sales tax rates in Ohio by address zip code. Answer A Few Questions To Get A Free Estimate Of Your 2022 Tax Refund.

All general questions or concerns can easily be directed andor handled by calling at 216 698-2540. 3850 cents per gallon of regular gasoline and 4700 cents per gallon of diesel. The total county lodging tax is 65 and is distributed as follows.

Advanced searches left. Forms The collection of Lucas County HotelMotel lodging tax as permitted by Chapter 5739 of the Ohio Revised Code is coordinated by the Office of Management and BudgetThe local rule for County lodging tax is the Lucas County Hotel Motel Tax Code of RegulationsThe tax is used to fund the Greater Toledo Convention and Visitors Bureau and the New Arena. Starting in 2005 Ohios state income taxes saw a gradual decrease each year.

The main functions include the collection and distribution of tax receipts and the conducting of audits of hotels and motels to ensure compliance with the tax regulations. For all filers the lowest bracket applies to income up to 22150 and the highest bracket only applies to income above 221300. Ohio has a progressive income tax system with six tax brackets.

In most countries the sales tax is called value-added tax VAT or goods and services tax GST which is a different form of consumption tax. Rates range from 0 to 4797. The city of Chicago imposes the following tax levies.

To use the calculator just enter your propertys current market value such as a current appraisal or a recent purchase price. Home Blog Pro Plans Scholar Login. There are more than 600 Ohio cities and villages that add a local income tax in addition to the state income tax.

Ohio Salary Paycheck Calculator. For example in youre staying in Columbus in Franklin County expect to pay a 10 percent nightly occupancy tax. First convert the percentage of the hotel tax to a decimal by adding a zero in front of the number not behind it and then shifting the decimal point two spaces to.

Ad Our Free Tax Calculator Is A Great Way To Learn About Your Tax Situation. 5100 Upper Metro Place 26-0331180 Dublin OH 43017 The person Signing this form MUST check the applicable box to claim exemption from the hotelmotel excise tax imposed by COLUMBUS CITY CODES Chapter 371. Depending on local municipalities the total tax rate can be as high as 8.

Can be used as content for research and analysis. Ohio Sales Tax Calculator. Just enter the five-digit zip code of the location in which the transaction takes place and we will instantly calculate sales tax due to Ohio local counties cities and special taxation districts.

Calculate your Ohio net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Ohio paycheck calculator. A 25 percent Metropolitan Pier and Exposition Au thority hotel tax a 35 percent occupancy tax a 2 percent sports and a 1 percent municipal hotel tax. Additional information can be found on the Departments Ohio Residency page.

Our calculator has been specially developed in order to provide the users of the calculator with not only how. Ohios counties and municipalities can charge occupancy taxes for each night you stay in a hotel room. 54 rows Convention hotels located within a qualified local government unit with.

Gingerbread House On The Lawn Raster Ad House Gingerbread Lawn Href Raster Ad Moving Truck House Moving Service Moving House

Right To Work For Less Warning Labels Lost Hotel Label Templates

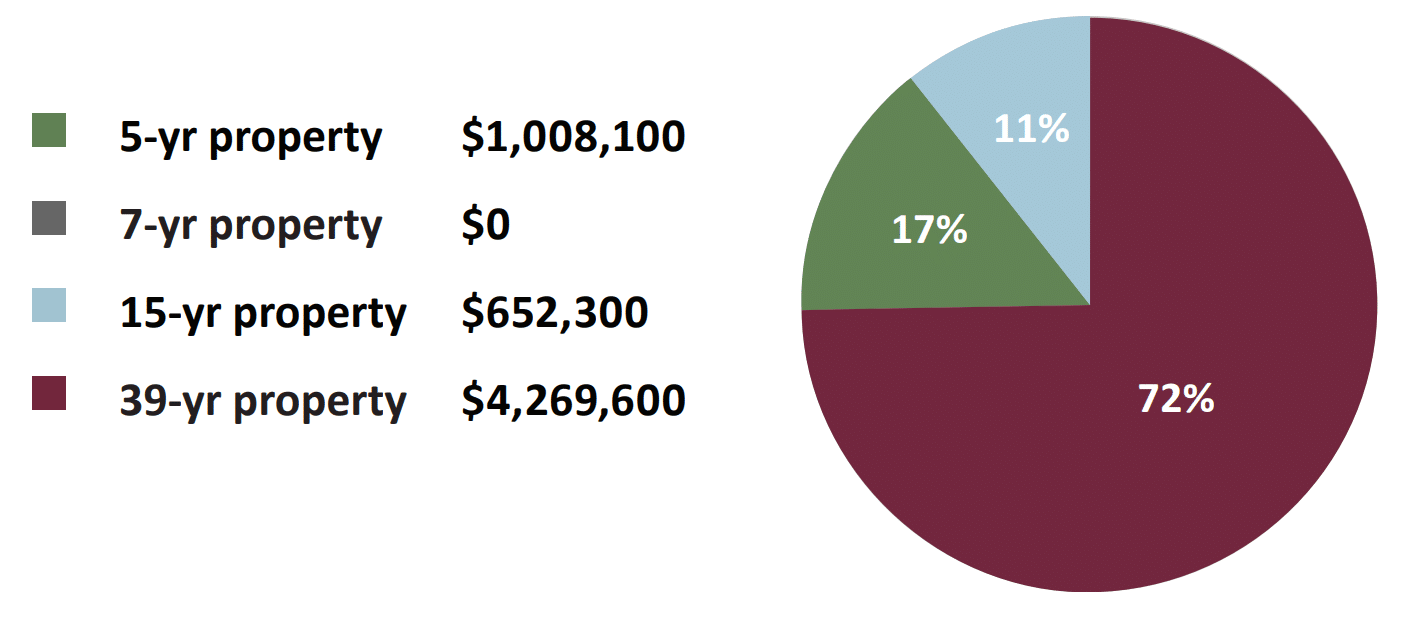

Hotel Cost Segregation Case Study

Hotel Operators Occupation Tax Excise Utilities Taxes

Cleveland Hotels Renaissance Cleveland Hotel

Educacion Financiera Marketing Budget Personal Financial Advisor Financial Advisors

The First Day We Met 10 April 2017 Anniversarygiftideas Anniversaryideas Love Giftsforhim Giftideas Health And Fitness Tips Best Self Fitness Experts

5 Tips For Wealth Management If You Want To Be Wealthy You Have To Learn How To Handle Money Wealth Management Wealth Management

Chicago Google Street Map Hyatt Regency Chicago Michigan Avenue Michigan Avenue Chicago

Cup Noodle Vending Machine Cup Noodles Vending Machine Cup

Cable Box Archives Stop The Cap Cable Bill Comcast Cell Phone Bill

Right To Work For Less Warning Labels Lost Hotel Label Templates

Pin By Hassan On Hhhh Let It Be Lets Get Started Coding

Messenger Coffee Company The Cappuccino Traveler Reviews Spring Break Trips Secret Places City Travel

Adidas Ultra 4d Semi Frozen Yellow Release Details Adidas Airliner Bags For Boys Sale Clothes Women Fitforhealthshops